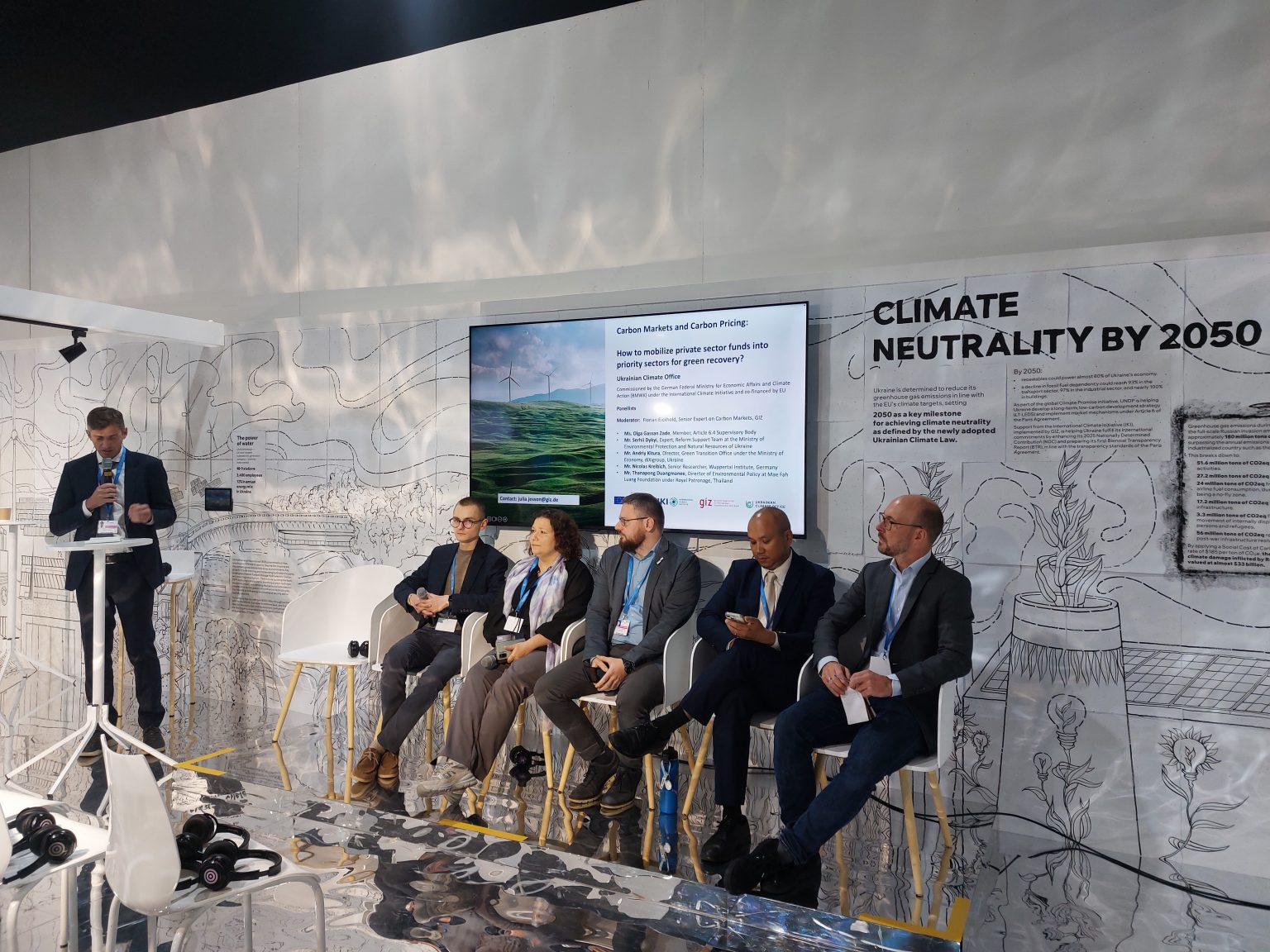

International and Ukrainian market experts discussed and shared their experience in attracting private investment in priority sectors for green recovery.

The expert panel was organised by the Capacity for Climate Action (C4CA) project / Ukrainian Climate Office and moderated by Florian Eickhold, Senior Expert on Carbon Markets (GIZ).

The discussion focused on how carbon crediting mechanisms and other carbon pricing instruments, such as carbon tax and emissions trading scheme, can be interlinked and potentially move from voluntary to compliance-based, expanding from national to international applications.

Government representatives and practitioners shared their experiences and expectations on how these policies can mobilise and encourage private sector investment for projects that reduce greenhouse gas emissions, support sustainable development and meet national goals, such as Ukraine’s green recovery initiative.

The panelists were:

- Olga Hassan Zadeh, member of the Article 6.4 Supervisory Body

- Sergiy Dykyi, expert of the Reform Support Group at the Ministry of Environmental Protection and Natural Resources of Ukraine

- Andriy Kitura, Director, Green Transition Office at the Ministry of Economy, diXigroup, Ukraine

- Mr Nicholas Kreibich, Senior Research Fellow, Wuppertal Institute, Germany

- Mr Tanapong Duangmanee, Director of Environmental Policy, Mae Fah Luang Foundation under the Royal Patronage, Thailand

In his presentation, Mr. Tanapong Duangmanee, Director of Environmental Policy, Mae Fah Luang Foundation under the Royal Patronage, discussed Thailand’s approach to carbon crediting, highlighting the establishment of the national T-VER system in 2016, which is designed to be aligned with future emissions trading systems (ETS). He noted the challenges associated with the Clean Development Mechanism (CDM), which led to the development of the T-VER system, which meets ISO standards for project verification. Thailand has registered 468 projects under this system, generating a significant amount of carbon credits across different sectors. The current carbon credit market in Thailand is voluntary and there are plans to improve these mechanisms under Article 6. Mr Duangmanee also mentioned the upcoming climate change law that will introduce an ETS, where a significant portion of the allowances will potentially be covered by existing credits.

Olga Hassan Zadeh, a member of the Article 6.4 supervisory body, noted a great interest in the experience of colleagues from Thailand and spoke about Ukraine’s achievements on the path to climate neutrality.

Olga noted that Ukraine is developing its own emissions trading system (ETS) with a view to joining the EU ETS after becoming an EU member. The country’s significant reconstruction and emissions management needs require a detailed legal framework and methodology. It is crucial for policymakers to learn from international experience and ensure clear funding for climate initiatives in order to properly assess and certify emission reduction projects.

Mr Nicholas Kreibich shared his vision of a voluntary carbon market, noting the need for capacity building in many countries to better understand and use carbon credits by different actors, including corporations. He cited the example of Germany, where there is uncertainty about the claims that companies can make based on their carbon credits. Kreibich emphasised the importance of understanding the potential demand and investment in carbon projects and noted the problems associated with the quality of projects under the current offset model. He introduced the climate contribution model, an alternative that allows corporations to support climate action outside their value chains without claiming carbon neutrality, which is increasingly difficult in Europe. He stressed the importance of clarity on opportunities, legal and institutional capacity to facilitate and attract investment.

Sergiy Dykyi stressed the urgent need for a green recovery in Ukraine, driven by the extensive damage caused by Russian aggression, which complicates and increases the cost of recovery efforts. He pointed to carbon markets and Article 6 as potential tools to facilitate this green recovery, which would not only help to achieve environmental goals but also strengthen energy security. Dykyi noted that Ukraine is actively studying and participating in discussions on the implementation of Article 6, focusing on ensuring environmental integrity and stakeholder engagement in the process. He acknowledged that both the ETS and Article 6 are evolving, suggesting that their integration and application will require more discussion and decision-making.

Mr. Andriy Kitura discussed the path taken by Ukraine and current strategies to ensure market readiness and carbon market development, drawing on his experience over the past 15 years. He noted that the current environment is more favourable for Ukraine to take significant steps towards the launch of an emissions trading system. Highlighting Ukraine’s commitments, including its accession to the Paris Agreement and its aspirations for EU integration, Mr Kitura said that the government is actively working on the implementation of a greenhouse gas emissions trading scheme (ETS) in Ukraine, is relaunching the monitoring, reporting and verification system next year, and has adopted a national energy and climate plan that envisages significant public and private investment in excess of €40 billion.

In conclusion, Ukraine is actively working to implement market mechanisms for decarbonization and green recovery amidst the extensive destruction caused by the war. Efforts focus on establishing an Emissions Trading System (ETS) and adopting international MRV standards to ensure effective monitoring, reporting, and verification. Utilizing tools like the carbon credit market under Article 6 of the Paris Agreement presents opportunities to attract investments, enhance energy security, and achieve climate goals. Despite the challenges, Ukraine has the potential to implement effective solutions, supported by prepared projects across various sectors, international support, and innovative financial approaches such as debt-for-climate swaps to alleviate debt burden while advancing decarbonization projects.

The event was organised by the Capacity Building for Climate Action (C4CA)/Ukrainian Climate Office project implemented by GIZ on behalf of the German Federal Ministry for Economic Affairs, Trade and Climate Protection (BMWK) within the framework of the International Climate Initiative (ICI) and co-funded by the European Union.